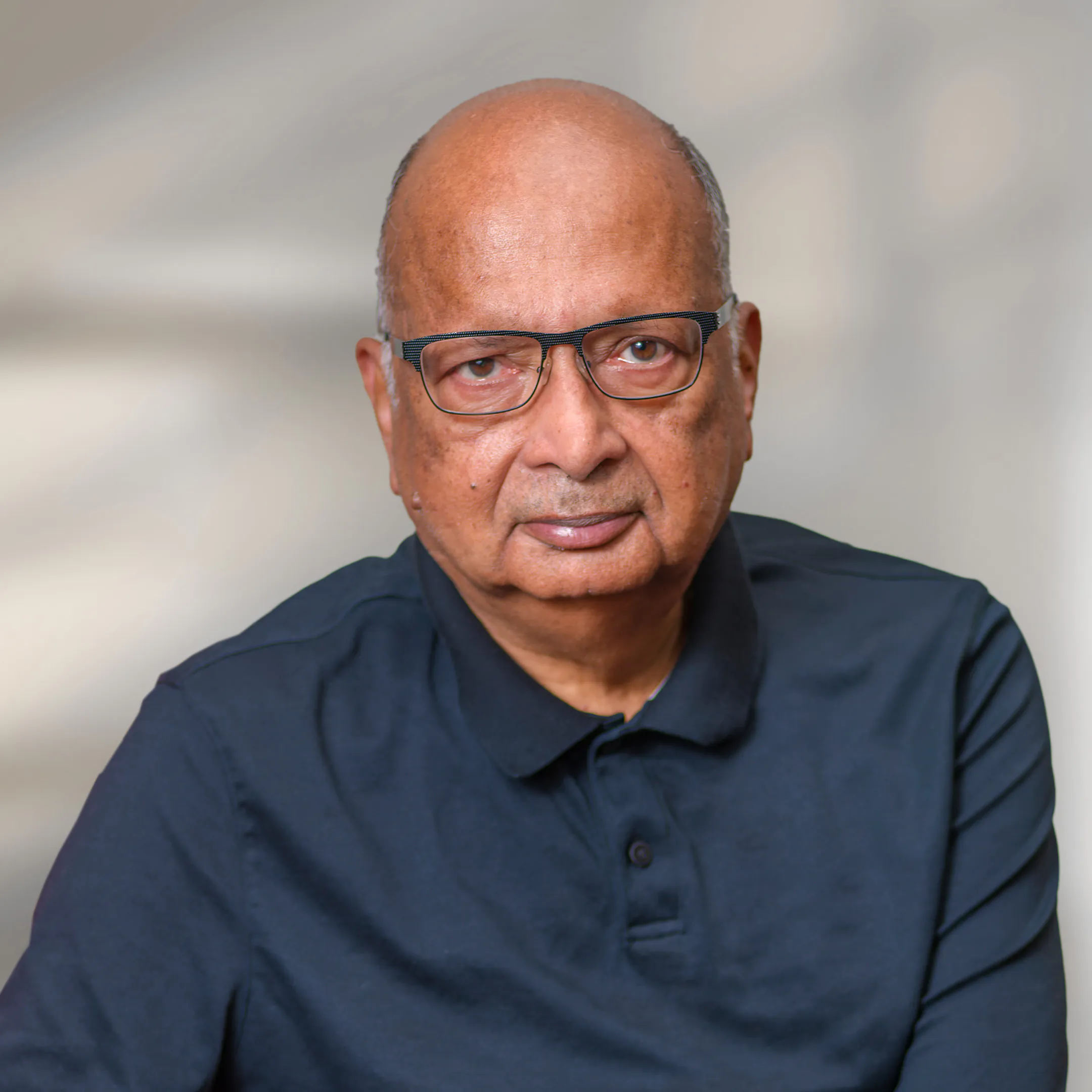

Anita Rehman

Anita Rehman is an investor, operating executive, and advisor with over twenty years of experience working in multiple geographies around the world and spanning the Clean Technology Education Technology, and Consumer Internet sectors. Anita has worked with startups, technology leaders, and investors specifically in the U.S. - India corridor. Her entrepreneurial and investment expertise will provide value to entrepreneurs and executives in the portfolio.

Prior to joining Celesta, she was a Partner at Global Silicon Valley (GSV). Before this Anita was Founder and CEO at an online ecommerce startup and an investor at Vantage Point Capital Partners, a $3B CleanTech Venture Capital Fund.

Anita earned her MSEE degree from Stanford after completion of her undergraduate studies at Manipal Institute of Technology, India. Subsequently, she obtained an MBA from the Wharton School of Business.

Focus Areas

Boards

Investing in a startup entails more than just capital; it demands knowledge, time, networks, and support to ensure its success.

Q&A

What excites you most about technology investing today?

The current tech landscape offers a remarkable opportunity for investing in entrepreneurs advancing the foundational technologies that will define the next generation. For example, the influence of Artificial Intelligence is reshaping entire industries and bringing forward groundbreaking innovations.

Technological advancements only continue to proliferate and accelerate, continually reshaping the world and how it works, but also opening up new opportunities for innovation. Consider the impact of cloud computing, which has democratized access to sophisticated infrastructure, freeing companies from the constraints of heavy capital investments. Cloud has become mainstream, but as the space has become more complex and critical to enterprise companies, new opportunities continue to emerge to help run cloud systems more efficiently.

In my view, the very best tech innovations also improve the quality of our lives.

How do you assess early-stage companies and founding teams for potential investment?

My approach to evaluating tech companies centers on two critical factors: the caliber of the team and the transformative potential of the product. A stellar team is critical for success, capable of surmounting challenges and navigating pivots, which are inevitable. Additionally, I place great emphasis on products that are transformational and differentiated. Such products are better poised for success and tend to experience rapid market adoption.

.webp)

.webp)

.webp)