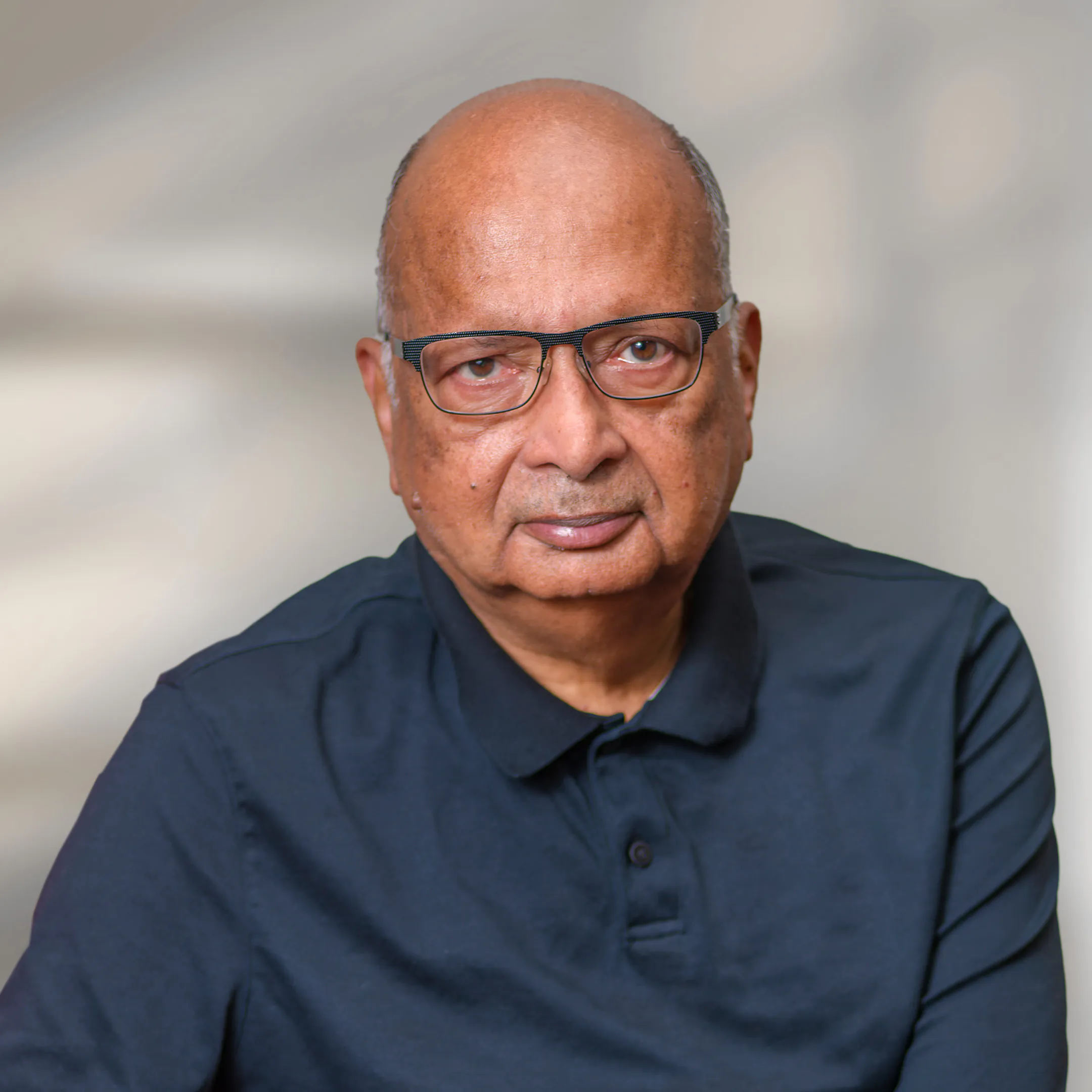

Michael Marks

For 40 years, Michael Marks has successfully led and transformed technology companies. He is a founding managing partner of Celesta Capital, where he co-leads the firm's investment and operations. Prior to Celesta, Michael was a founding partner of Riverwood Capital, a Menlo Park-based private equity firm, and served as Partner and Senior Advisor at Kohlberg Kravis Roberts & Co. He spent 13 years as CEO and then chairman of Flextronics International Ltd., building it into one of the largest technology companies in the world. Michael also served as an Interim CEO at Tesla.

Michael served as an Adjunct Professor at Stanford Graduate Business School from 2008 - 2017, and is currently a Board Director for over 20 companies. Michael previously served as a Director for Schlumberger Limited, GoPro, and SanDisk, among others.

"The entrepreneur has to be a true believer. You look at these great, successful companies that have been built in the world…they start them because they’re on a mission. I always begin there. If people are not passionate, it never works."

Q&A

Do you have any advice for an entrepreneur who's looking for funding right now?

First, companies should be very careful with whatever funding they currently do have knowing that it is a tough environment right now for fundraising. VC companies like us are tending to keep our powder dry for the existing companies we have which may have capital needs in the near term.

The second thing is they should solve for capital, not valuation. In this environment, you don’t have the leverage to drive a hard bargain in terms of price. You must take the terms you can get to secure the capital you need to keep moving forward. Live to fight another day, continue building value in your business, and the valuation of your company will take care of itself in the long run.

What do you think sets Celesta apart as a firm?

There are two things that set us apart. One is that we have operating capabilities. When we talk about helping our companies, we actually get deeply involved and help run the companies, which is definitely not the norm for venture funds. We do it because we’re good at it and we understand it, which can be very helpful to early-stage companies.

The second thing is we have extraordinary technical capability in our firm. We're not just investors, we also have very deep domain expertise in the firm within the areas of tech we focus on. We have multiple partners with strong technology backgrounds, which not only gives us the opportunity to help our portfolio companies, but also to better understand the technologies prior to making investments. We can genuinely understand potential implications of the technologies, possible obstacles, and so on.

We want Celesta to be recognized as a firm where founders and entrepreneurs want to have us as investors because they know we can help them. They know we're value-add investors, that we will roll up our sleeves with them, that we have a strong ecosystem, and we can help them in ways others can't. Frankly, that's happening all the time now and it’s very energizing for us as investors to have people want us in the room. I hope we continue to build on that so we're the first phone call a founder makes.

.webp)

.webp)

.webp)