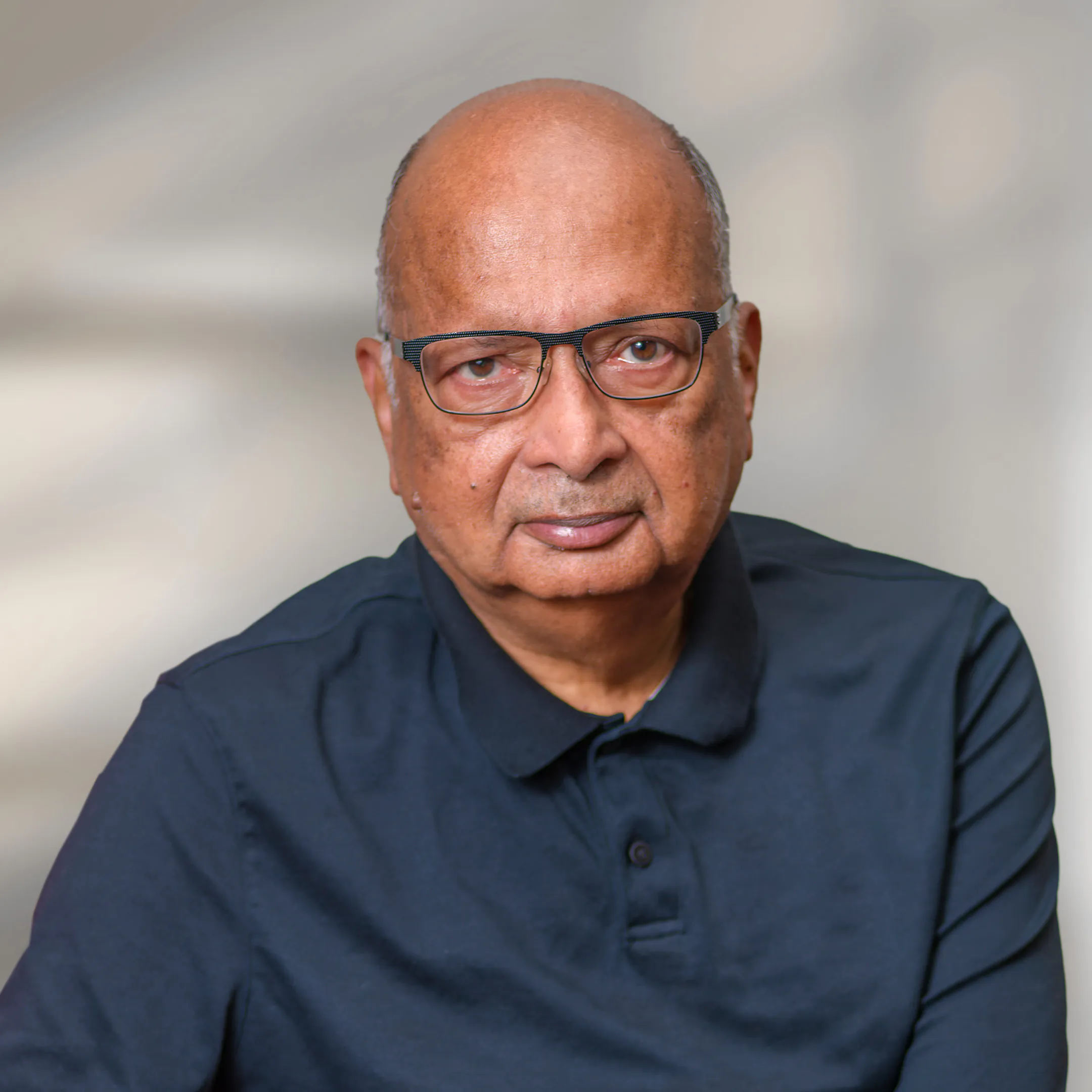

Sarah Lucas

Sarah Lucas is a seasoned professional with a proven track record of building successful brands and leading high-impact companies. As an Advisor at Celesta Capital and Managing General Partner at Lucas Venture Group, Sarah is dedicated to identifying and supporting transformative startups across a wide range of industries. Her extensive experience in investing, talent acquisition, and leadership makes her an invaluable asset to the founders and teams she works with. At Celesta, Sarah spearheads our efforts to invest in and nurture underrepresented and non-traditional entrepreneurs, providing critical capital and strategic guidance to help them achieve success in the early stages of growth. Sarah is committed to promoting diversity, equity, and inclusion in the venture capital industry.

What I love most about venture is the opportunity to solve the world’s problems (there is no shortage of those) and contribute positively to humanity. Deep tech allows you to truly invest in the technological engine that powers our modern world, and to see what is coming down the pike.

Q&A

What does your role as an Advisor with Celesta entail?

I lead our strategy for supporting female and minority entrepreneurs, but also support our team in the due diligence process on a wide variety of companies. Where my partners have off-the-charts technical and financial expertise, I am the “people” person. The product can be stellar and check all the boxes, but if the management team isn’t equally as stellar – it is a pass. Sometimes in a pitch, I am only looking for those clues, knowing my partners are deeply focused on the other aspects of the company.

How is Celesta’s investment approach unique compared to other firms?

We all work on deals together – there is no competition but a collective sense of ownership – and we make investment decisions as a team, with no one voice more important than another. We pride ourselves on being active investors, not just check writers. The GPs lead by example on this, and we are encouraged to leverage the firm’s network to support our companies and bring company’s issues to the table for brainstorming. When we invest in a company, they are like family.

How can more women break into venture capital?

It is about access – so the women, like myself, who are currently in a position to be helpful, need to do so. It is up to us to open those doors, and then up to them to be prepared to walk through.

.webp)

.webp)

.webp)